Price Ramping Maximizes Lifetime Value with Scalable Pricing

Instead of locking customers into flat rates, Price Ramping lets you build subscription contracts that grow over time. By aligning pricing with customer value and usage maturity, you remove friction from deal closure while expanding revenue predictably. This feature is crucial for B2B SaaS and service companies with evolving pricing models.

What Is Price Ramping and Why Does It Matter?

Price Ramping allows you to schedule pricing changes over the life of a contract. Rather than applying a fixed price for the full term, you can define a sequence of prices—monthly, quarterly, annually—tailored to the customer’s usage journey or your strategic pricing roadmap.

Here’s why it matters:

- Flexible pricing removes early-stage objections, especially for large multi-year deals.

- It accommodates growth-oriented customers who want to commit but scale gradually.

- It aligns price with realized value, which makes expansion smoother and more justified.

This is especially effective for SaaS, services, or B2B product companies that sell in phases—onboarding, adoption, and scale.

The Problems Fixed by Price Ramping

- Flat-Rate Contracts Limit Growth

You sign a 3-year deal, but the price stays fixed—even as customer usage soars. That’s lost revenue and diminished ROI per account. - Manual Adjustments Introduce Risk

Finance teams often manage mid-contract changes via spreadsheets or disconnected systems, increasing the chance of billing errors and customer dissatisfaction. - Customer Pushback on High Starting Costs

Prospects hesitate to commit to high pricing in year one. Without ramping, deals stall or shrink.

What Makes Expedite Commerce’s Price Ramping Stand Out?

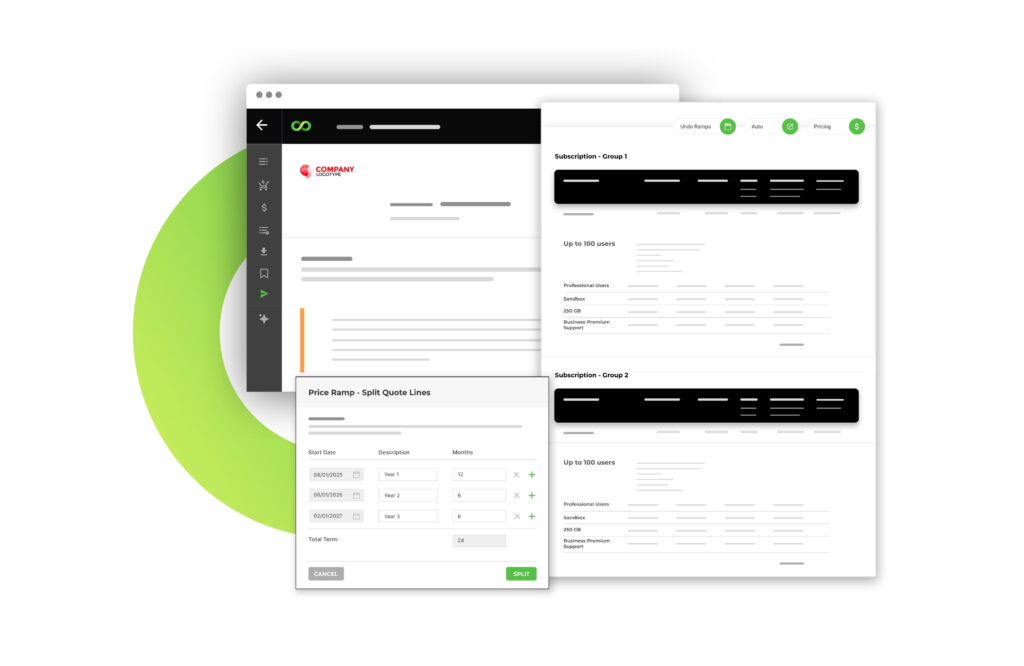

1. Intuitive Setup for Quote-to-Cash Teams

Quote ramped pricing for any product, SKU, or service within the CPQ flow. Users can easily define:

- Ramp periods (e.g., Year 1: $10K → Year 2: $15K → Year 3: $20K)

- Start and end dates

- % increase or fixed price jumps

This structure flows seamlessly from quoting to billing, ensuring accuracy and automation throughout.

2. Multi-Year Deal Support

Whether your deal spans 12 months or 36, Expedite Commerce lets you tailor price ramps by month, quarter, or year. This is essential for:

- Enterprise SaaS contracts

- Managed service agreements

- Usage-based products with tiered consumption

3. Unified Visibility

Price ramping doesn’t live in a silo. It’s reflected in:

- Quote PDF and contract language

- Billing schedules and invoice generation

- Revenue recognition and forecasting modules

Key Business Benefits of Price Ramping

Outcome | Flat Pricing | Price Ramping |

Deal Flexibility | Rigid, one-size-fits-all | Adaptive to customer growth |

Forecast Visibility | Static | Predictive, ramp-aligned |

Risk Mitigation | Manual adjustments required | Automated across systems |

Upsell Momentum | Requires renegotiation | Built into initial contract |

Time to Close | Slower due to pricing concerns | Faster with graduated pricing |

Example Use Case: 3-Year SaaS Contract

Without Ramping

You quote $60K/year for a 3-year deal = $180K TCV. Customer pushes back due to year-1 budget constraints.

With Ramping

- Year 1: $40K

- Year 2: $60K

- Year 3: $80K

→ TCV = same $180K, but now aligned to customer value milestones. Deal closes faster, with higher customer buy-in.

Ideal Use Cases for Price Ramping

- Early-stage growth companies scaling their use over time

- Multi-phase implementation deals where full product usage starts later

- Enterprise accounts that commit long-term but require budget flexibility

- Product launches where price tiers evolve over time

- Service contracts with increasing scope or headcount

Price Ramping vs. Traditional Pricing: A Strategic Advantage

Feature | Traditional Pricing | Price Ramping |

Customization | Low | High |

Revenue Realization | Delayed via renegotiation | Automated in contract |

CX Alignment | Static experience | Evolves with customer |

Sales Cycle | Friction-heavy | Faster close rates |

Finance Sync | Requires manual tracking | Automated billing integration |

Frequently Asked Questions (FAQs)

Is price ramping the same as discounting?

No. Discounting reduces total contract value. Ramping preserves TCV by deferring higher pricing until later stages of the contract.

Can price ramping be tied to product usage?

Yes. You can align ramp periods to expected usage maturity or milestones—e.g., feature adoption, usage volume, headcount, etc.

What if a customer cancels mid-ramp?

Your ramped contract structure ensures that billing and revenue recognition adjust accordingly—protecting revenue integrity.

Can we combine price ramping with term-based discounts or prepayment offers?

Absolutely. Expedite Commerce supports complex deal structures with layered pricing logic.

Who benefits most from this feature?

SaaS companies, service providers, and anyone selling contracts that span more than a year with anticipated customer growth.

Want to quantify the RoI of eliminating quote friction?

Get access to our RoI Calculator—see how much revenue your team could recover just by simplifying quote initiation.