Low CPQ Adoption Is a Revenue Killer—Here’s How to Fix It Most CPQ tools fail not because they lack features but because reps avoid using

Poor Quote Templates Undermine Deals—Dynamic Quote Content Fixes That Your quote template isn’t just paperwork—it’s a revenue lever. Outdated, fragmented, or unpolished quotes slow sales

Misconfigured Deals Put Revenue at Risk—CPQ Rule-Driven Configuration Fixes It Complex products lead to complex quoting logic. If that logic lives in spreadsheets or siloed

Faster Quote Initiation Accelerates Revenue Quotes don’t stall at negotiation—they stall before they’re even created. Quote initiation friction slows sales velocity, impacts forecast accuracy, and

Inconsistent Discounting Quietly Erodes Margins—AI Can Fix It Hidden margin loss often comes from undisciplined discounting, not cost structure. Reps under pressure to close deals

Rate Plan Misalignment Creates Forecasting Chaos—Here’s the Fix In a consumption-based revenue model, one wrong rate plan selection can distort forecasts, margins, and renewals. Embedding

Manual Rate Plan Selection Creates Risk—Automate It for Consistency Selling usage-based pricing can be a growth driver—until reps pick the wrong rate plan. Manual rate

Rate Plan Selection Should Be Data-Driven—Not Guesswork In consumption-based pricing, choosing the right rate plan shouldn’t require spreadsheets and back-of-the-envelope math. A CPQ Rate Plan

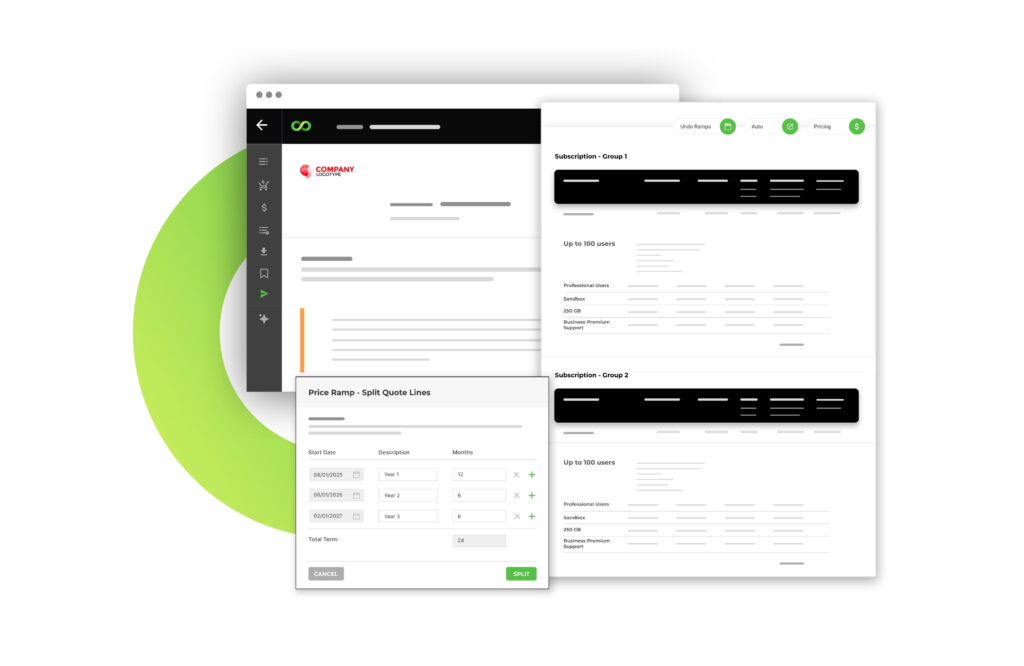

Structured Ramp Pricing Eliminates Approval Guesswork Approving multi-year deals shouldn’t require rebuilding quotes in spreadsheets. Ramp pricing in CPQ structures discounts, pricing changes, and SKUs

Get access to our RoI Calculator—see how much revenue your team could recover just by simplifying quote initiation.